An update on QSA's finances for 2021-22.

In the previous financial year ending 31 March 2021 the Covid-19 pandemic had started, creating much financial uncertainty. However QSA ended that year with a positive financial result due to its financial prudence in terms of controlling expenditure, and the generosity of its supporters and funders.

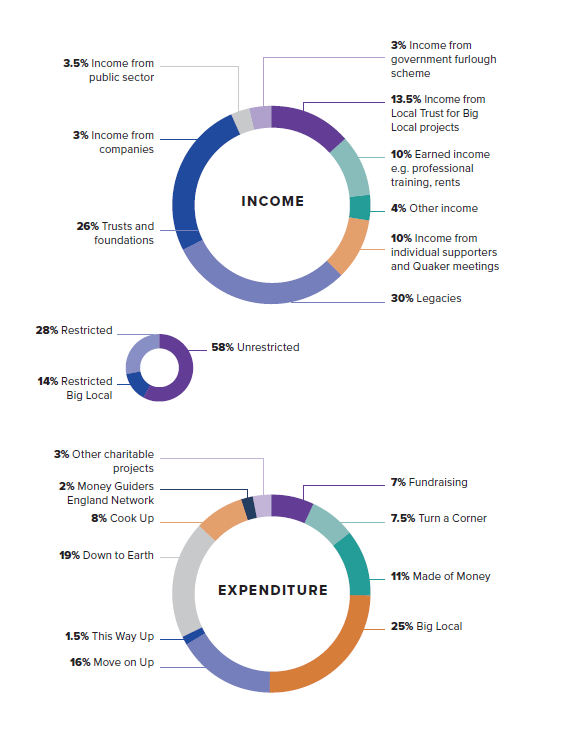

During the financial year ending 31 March 2022, QSA’s income of £1,598,411 exceeded expenditure of £1,527,628 giving a surplus of £67,870, including an increase in unrestricted funds of £94,526.

Of the total income, £216,668 was income from Local Trust which QSA receives on behalf of the Big Local projects for which it is the Local Trusted Organisation (LTO).

Unrestricted income was 58% (£933,211) of the total – unrestricted funds are crucial in enabling QSA to respond flexibly to the needs it identifies.

A very significant factor in QSA’s positive financial result for 2021-22 was an unusually high level of income from legacies, totalling £484,460.

QSA’s reserves on 31 March 2022 sat at £1,907,433, consisting of £1,022,284 in restricted funds and £885,149 in unrestricted funds. The latter figure is composed of £735,326 in designated funds and a general fund of £149,823.

The reserves are managed by QSA’s finance and fundraising sub-committee, which uses a risk-based approach to identify key financial risks and designate reserves to offset these risks. Accordingly, £219,234 is held for emergency or wind down scenarios, and £417,473 for operational contingencies given that we fundraise in-year. The remainder of the designated fund is £98,619 in fixed assets.