To mark the launch of QSA's Family Friendly Money project, here's a tip on helping your teens to make money plans - that plays to the strengths of their brain's stage of development.

We want our teens to understand why it’s important to plan their money, and to know how to do it.

It can be tempting to start the conversation by asking them the big questions about their future. But thinking about what job you want to do, or if you want to go to university, can feel a long way off when you're 13!

The parts of our brains that deal with reasoning and organisation don’t finish developing until the age of 24 on average. So our teenagers’ brains are still in this evolving stage, and this can affect how they think about the future.

Talk to your teen about the things they want now

It can be more helpful to talk to your teen about money planning in relation to things that will happen soon.

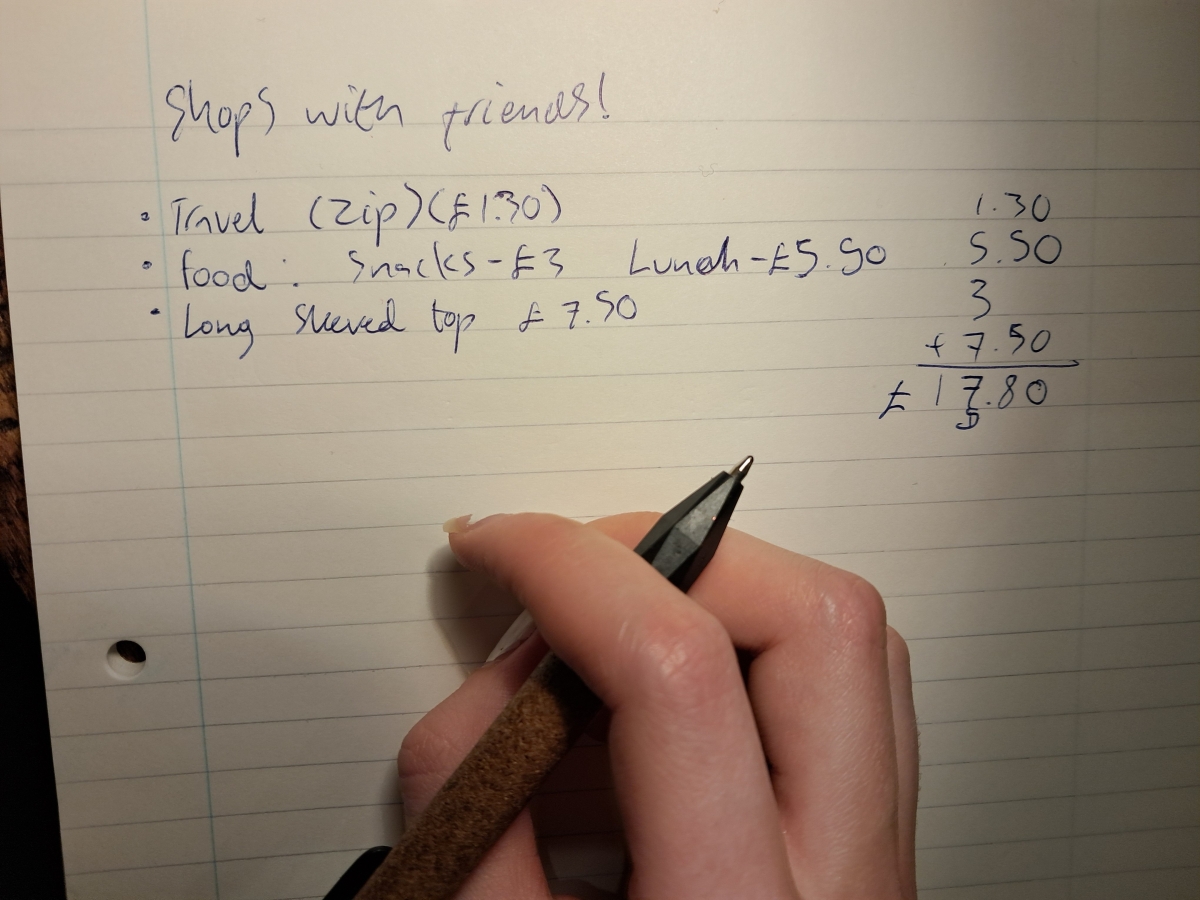

If there’s something coming up like an event or a holiday, or if they want to buy a more expensive item - give them real-life experience of making money plans, by helping them to budget for it.

Ask questions to help them make their plan

Asking questions is a great way to help them make their plan. You could ask:

- How much will it cost to get there?

- Is there any clothing or equipment that you need, that you don’t currently have?

- Will you need a snack?

- What else might you need to make the trip go well?

Once they have an estimate of how much they need to spend, together you can think about whether they have enough money now, or if they’ll need to save up.

If they need to save up, you might ask:

- How much will you put aside each week?

- Where will you keep the money you’re saving?

Let them experience the positive feeling of planning for the future

If your teen plans for something that is important to them and that they’ll enjoy soon, you’ll be creating an opportunity for them to experience the positive emotions we feel when we plan something for the future.

This tip is from the Family Friendly Money Facebook page.

Follow the page to see bite-sized tips on how you and your children can get more from your money.

Or subscribe to the Family Friendly Money newsletter to get the tips direct to your inbox, once every three weeks.

We're sharing this tip to mark the launch of Family Friendly Money. This new project of QSA shares bite-sized tips and online learning giving parents money skills info that’s simple, quick and available 24/7. Click here to learn more.